[新しいコレクション] 50/20/30 budget 309756-50/20/30 budgeting worksheet

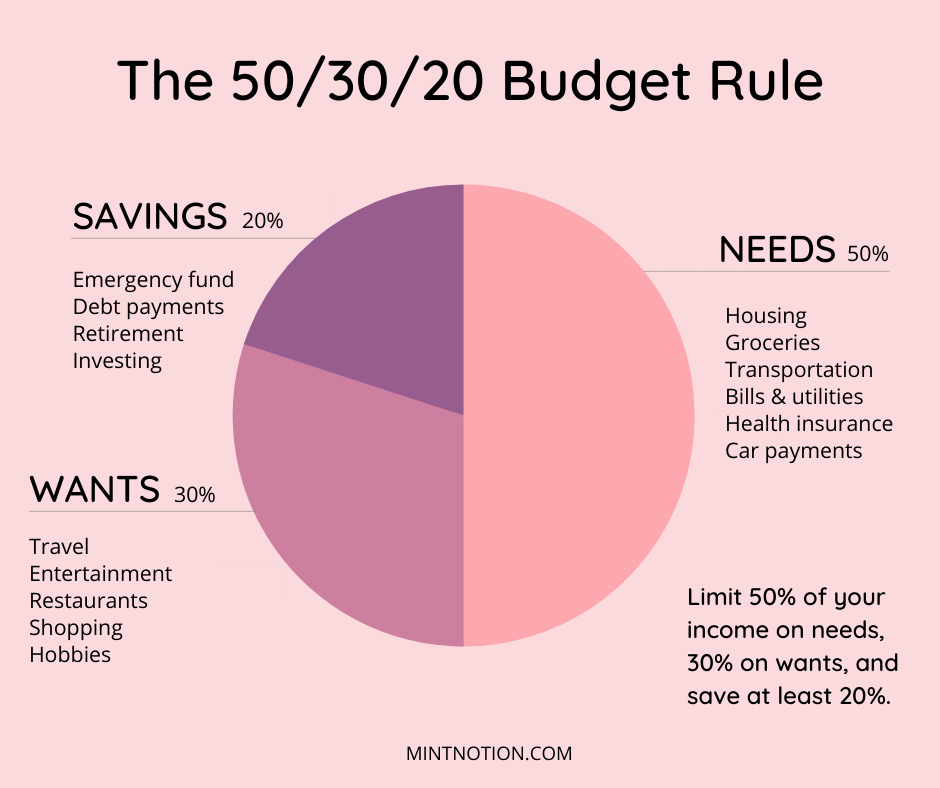

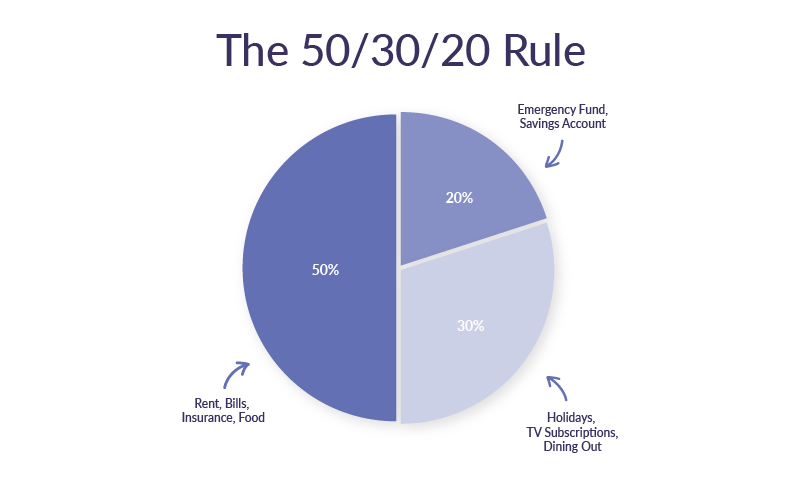

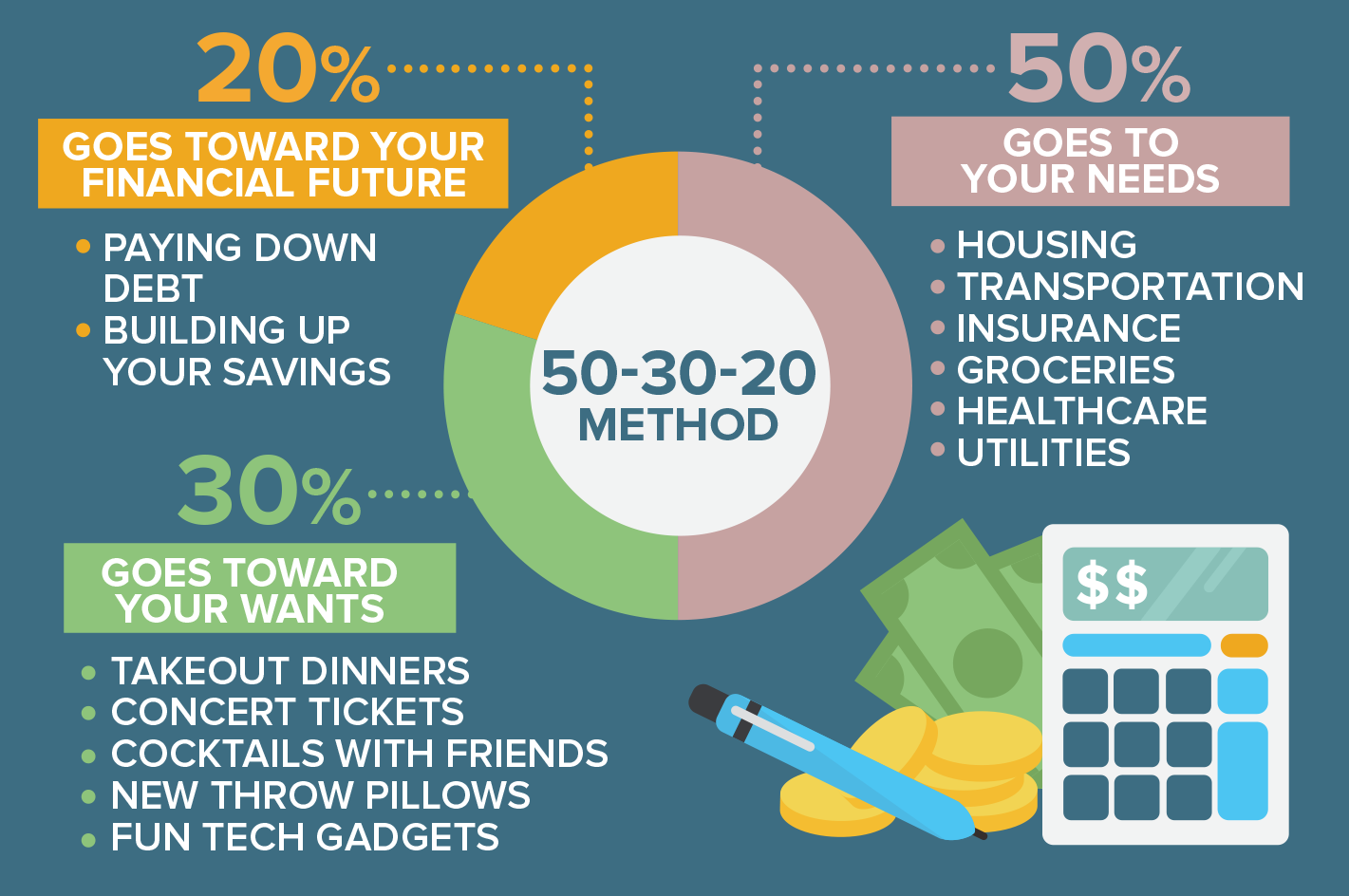

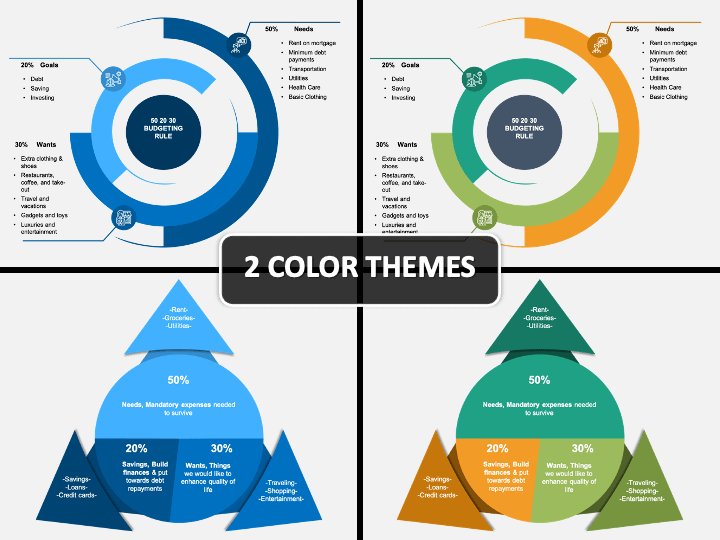

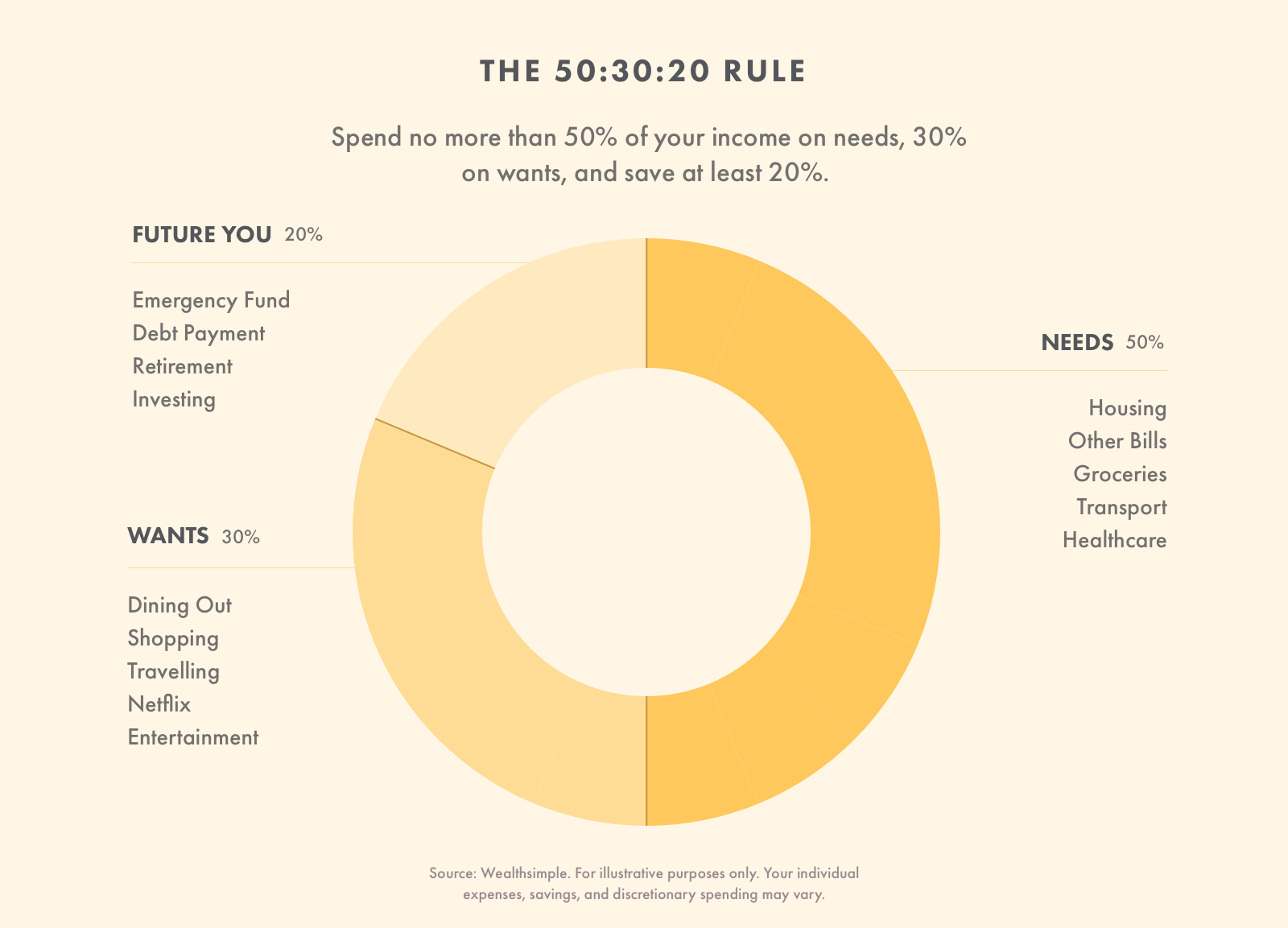

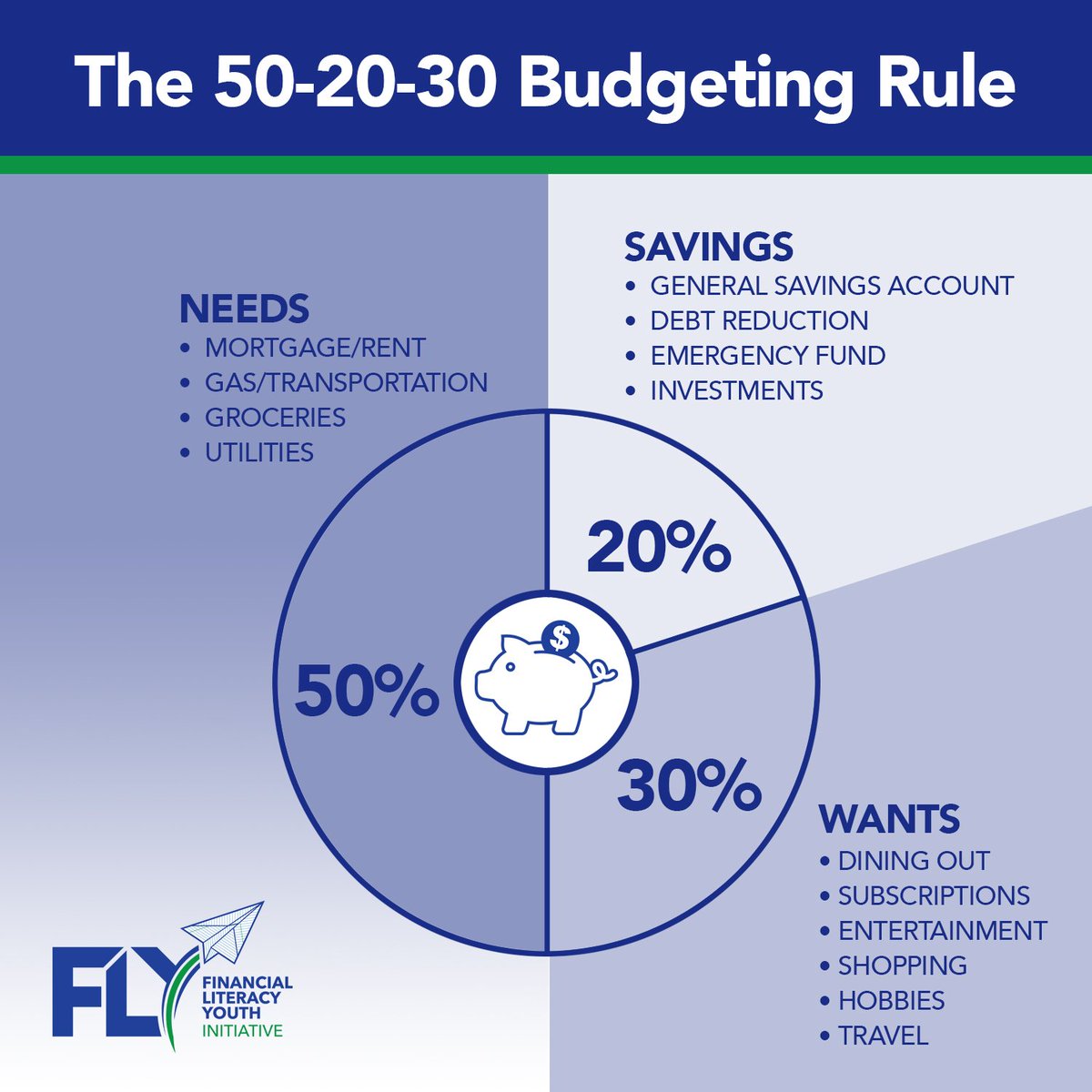

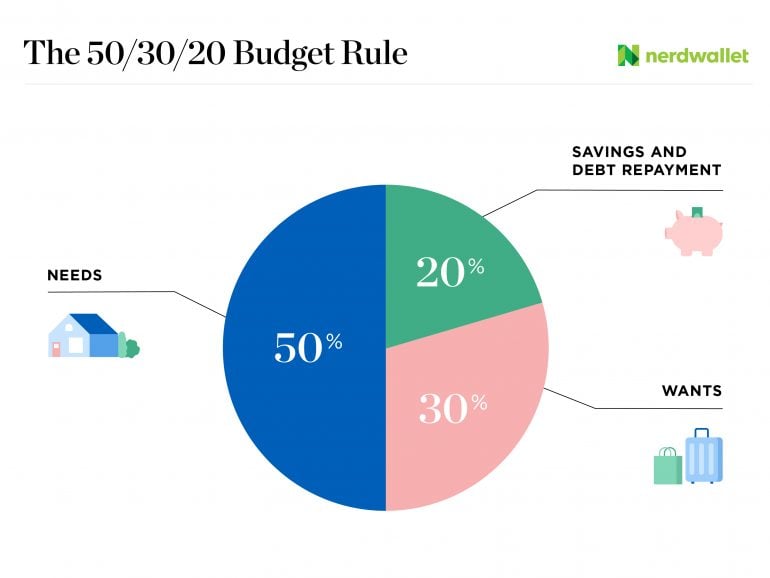

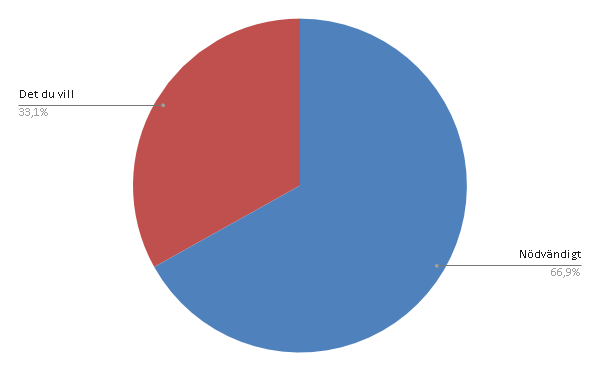

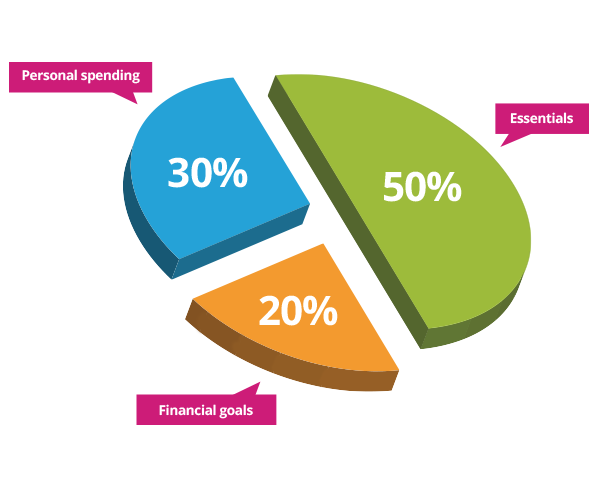

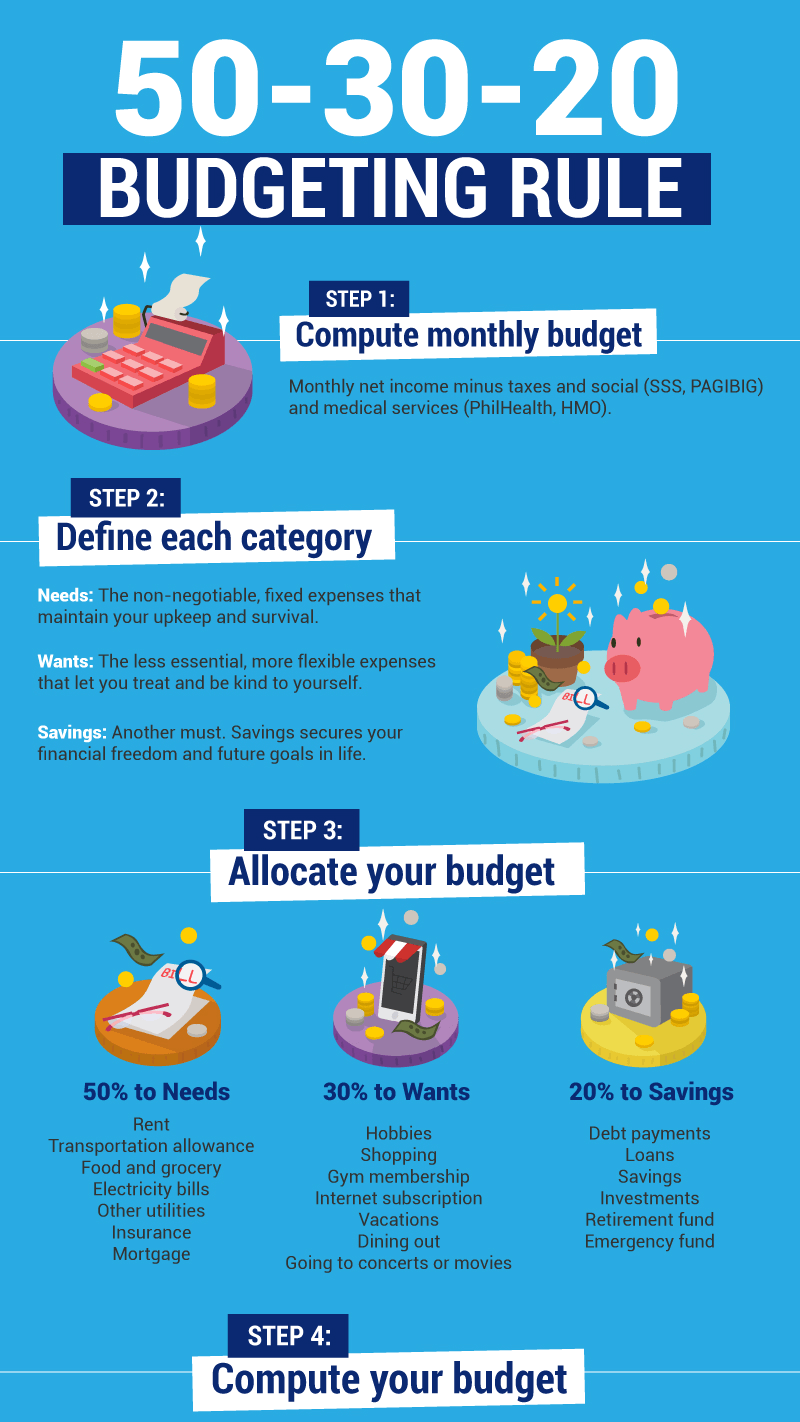

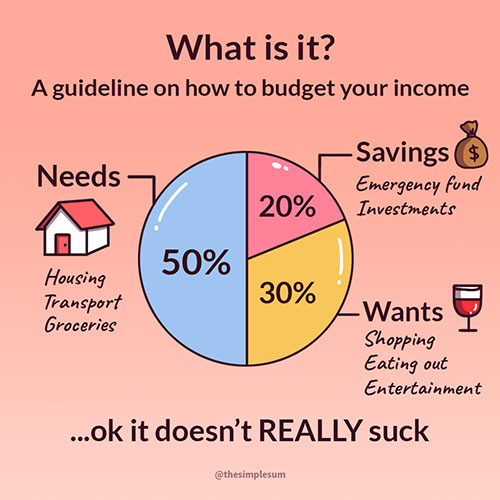

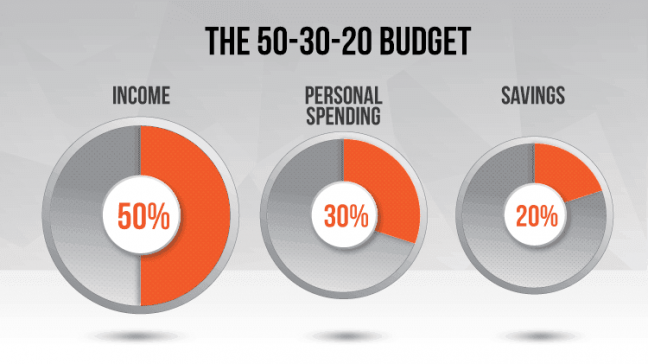

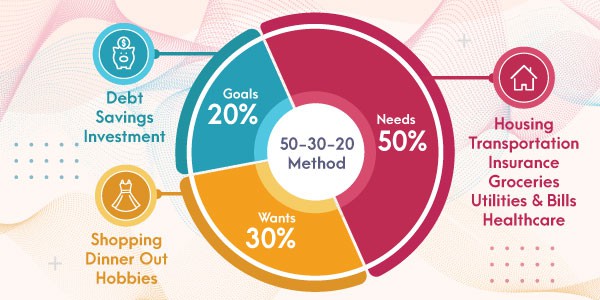

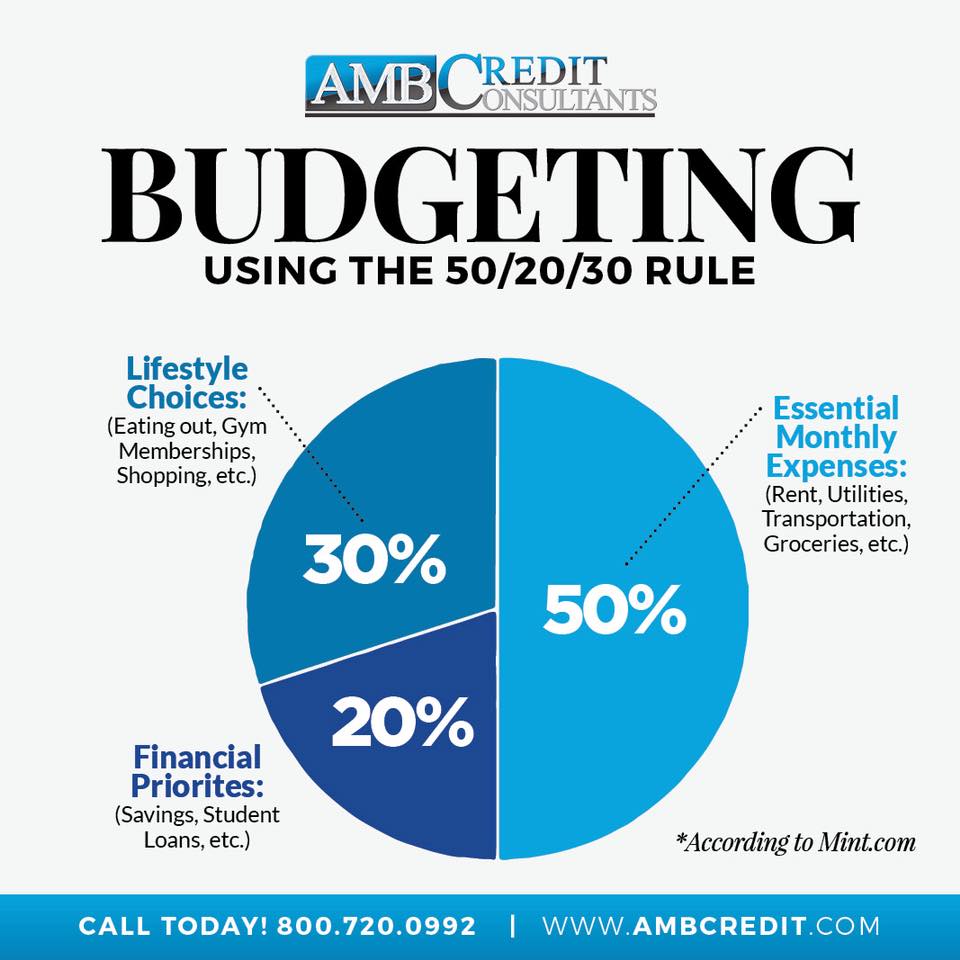

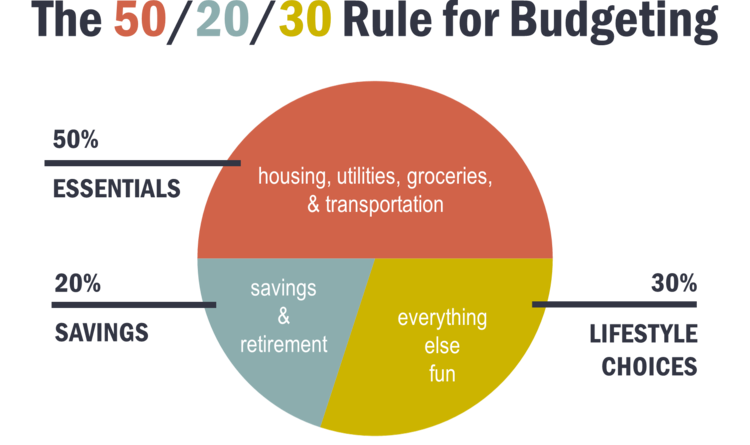

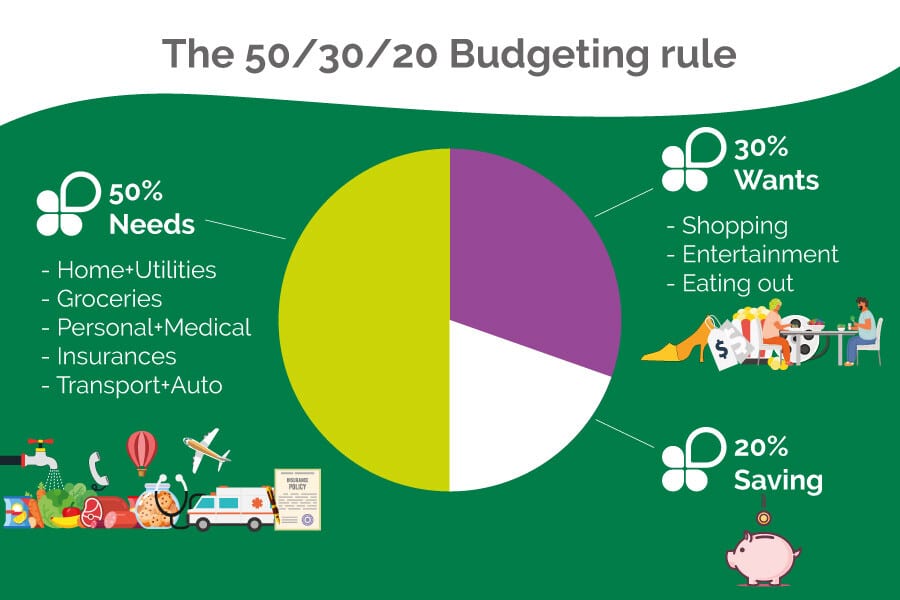

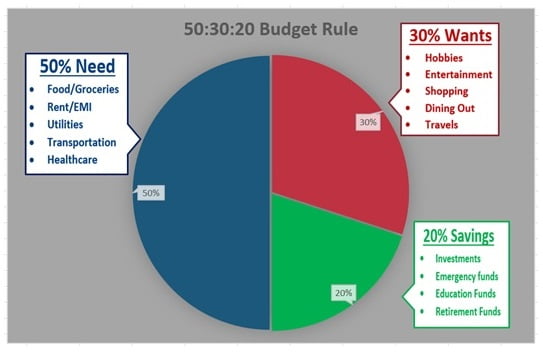

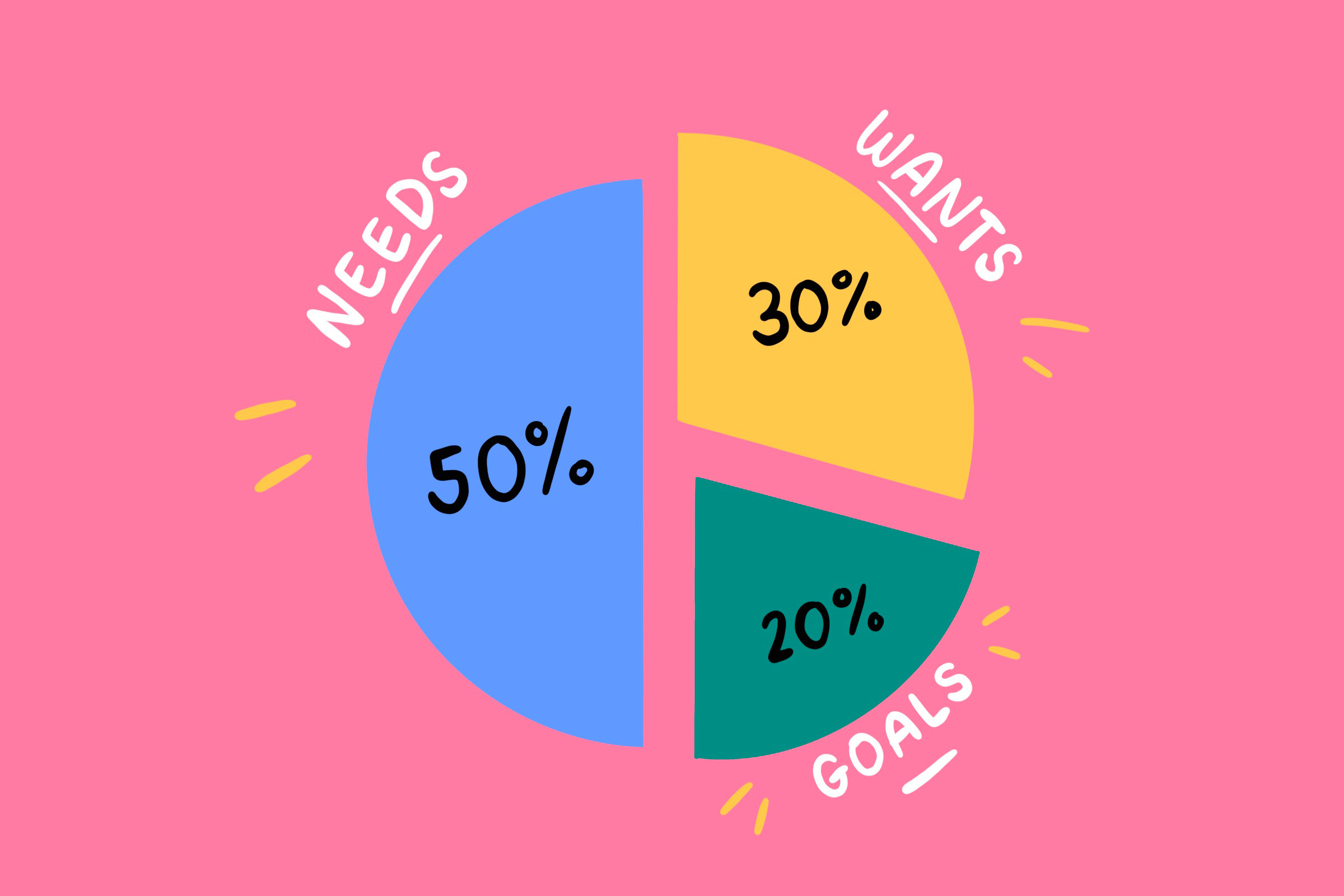

The 50//30 budget rule is the most talked about method when it comes to managing your finances, and some people swear by it because it's an easytofollow method when it comes to managing expenses across your wants, needs and savings50/30/ Budget Categories 50% Essential Expenses The 50/30/ budget puts 50% of your monthly income straight towards the things you can't live without These include things like your mortgage/rent, utilities (heat, water, electricity), food, and transportation *Many finance bloggers will sneak a cell phone bill into this categoryThe rule is a money management technique that divides your paycheck into three categories 50% for the essentials, % for savings and 30% for everything else If the budget doesn't fit your lifestyle, try one of these instead While it might be easy to remember, the rule isn't always easy to live by

3

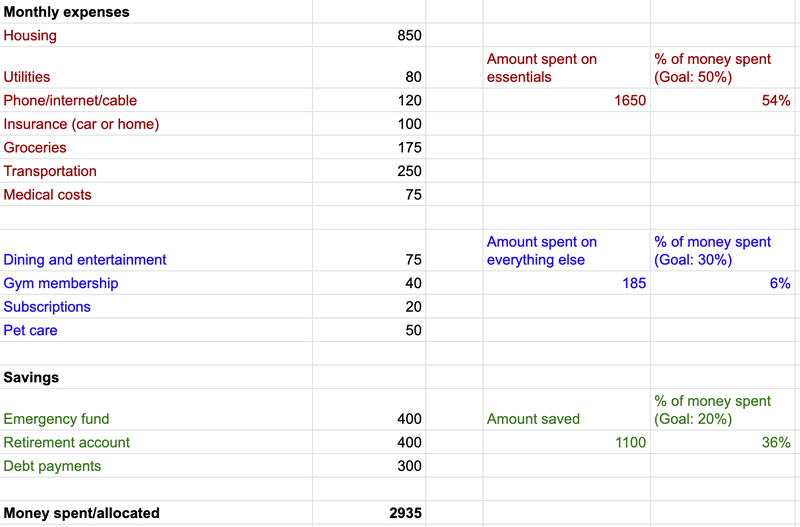

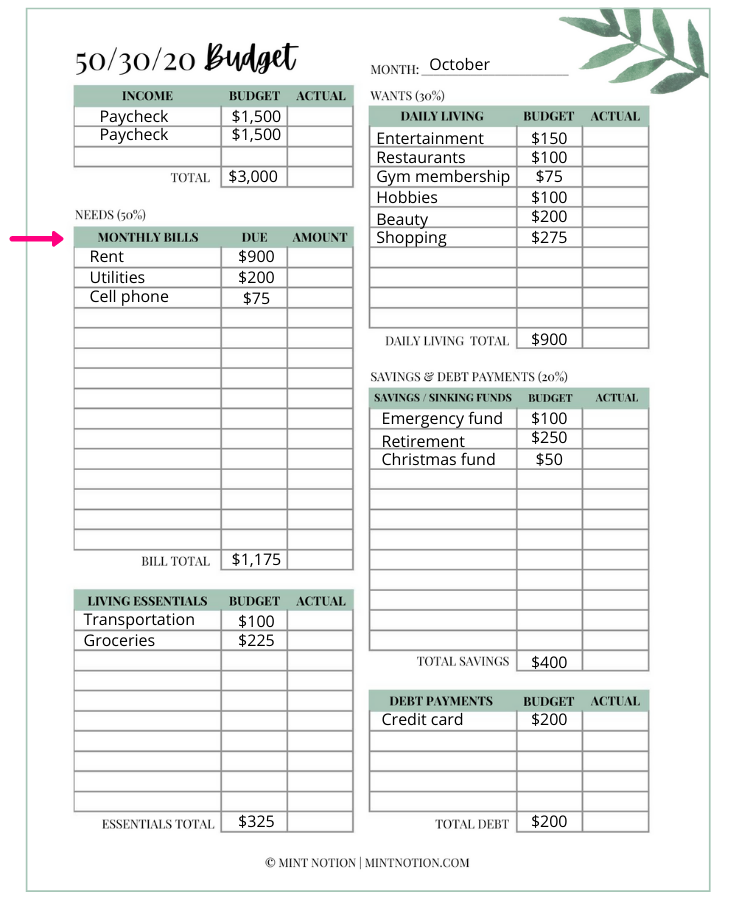

50/20/30 budgeting worksheet

50/20/30 budgeting worksheet-50 30 budget excel template worksheets offers your Excel worksheet extra convenience In order to use Excel worksheets to do the work that you want, it is necessary to know exactly how to utilize the formulas and data that are included in the templateHow the 50/30/ Budget Works The lean and easytounderstand 5030 budget calculator has been around since at least the early 00s Popularized by Elizabeth Warren in her book, "All Your Worth," this budget divides 100% of your paycheck (aftertax income) into the three categories Things You Need 50% Things You Want 30%

50 30 Budget Kimberly R Jones Budget Planning

The budget (or rule as it's sometimes referred) is a percentagebased budget concept that emerged in the late 90s This is a popular budgeting style due to its simplicity, flexibility and how it can apply to different stages of life It's based on percentages and not how much you earn, so you can adapt it to your own circumstancesThe 50/30/ rule of thumb is a guideline for allocating your budget accordingly 50% to "needs," 30% to "wants," and % to your financial goals It was popularized by Elizabeth Warren and her daughter, Amelia Warren Tyagi Your percentagesThe (or 5030) budget rule is an intuitive and simple plan to help people reach their financial goals The rule is a template that is intended to help individuals manage their money and save for emergencies and retirement

Ska du följa den här länken 50% får gå5030 household budget percentages – a $125,000 income example This example is a couple making $125,000 per year I'm also assuming a 25% tax and employer deductions (before retirement and medical benefits) Also, note in this scenario, the couple has made the choice to have 3 childrenDebt In other words, how much money gets dropped into your bank account after taxes are accounted for, set aside, or spent on a whim 2

The 5030 budget rule is very simple To get started, you need to figure out your aftertax income Aftertax income is simply the amount of money you have leftover after taxes are removed These taxes include federal, state, medicare, and social securityAtt göra en hushållsbudget enligt 50/30/ regeln innebär just det Om du söker ett lite bredare inlägg där vi gör en hushållsbudget från grunden, där 50/30/ regeln är en del, såPublicerad apr 24,

Budgeting By The Numbers The 50 30 Budget Debtguru Credit Counseling And Debt Management Services

1

How to get started on the 50/30/ budget rule 1 Look at your takehomepay An important thing to tune into is how you divvy up your income based on your Wants, Needs, and Savings &50/30/ budget A simple way to organize your finances, make progress, and avoid stress Creating a budget helps you stay on top of your finances, learn where your money is going, and save for the future Even so, some people can find the task confusing or daunting A 50/30/ budget is a simple, easy way toWhen it comes to budgeting your income, there are many methods you can use One of the most common is the 50/30/ rule Learn how to apply it here

Why Is The 50 30 Rule Easy For People To Follow Especially Those Who Are New To Budgeting And Saving It Keeps Your Finances Simple And Is A Good Starting Point For Novices

Prova 50 30 Metoden For Din Budget Valkommen Till Stabilekonomi Se

Monthly budget example Ok, so let's say you get paid approximately $1,0 twice a month That's $2,400 total per month Now split that three ways according to the 5030 rule 50% of $2,400 is $1,0 30% is $7 % is $480But as a longterm budgeting strategy, the 50/30/ budget might not hold up as well as a traditional lineitem budget That's because the 50/30/ split makes less sense above a certain income bracket When you're making an entrylevel salary, the 50/30/ ratio is perfectLet's take a look at an example budget to show you how it might look when you first set up your 50//30 budget, which you can do in a simple spreadsheet or by using a budgeting app and taking a

Do You Have Trouble Budgeting Try The 50 30 Budget Rule

50 30 Rule Of Money Saving Money Budget Money Management Advice Money Saving Strategies

The 50/30/ rule is a budgeting framework that outlines what percentage of your income to allocate for the three of the most important parts of your budget The premise is simple — you allocate 50% of your budget for your essentials, 30% for extras, andA 50//30 budget can help you with your budgeting because it will tell you exactly what category your income should go into and exactly how much money should go into each category When you use this method of budgeting it helps you prioritize your money, figure out your wants and your needs, pay off more debt and maximize your savings and retirementThe Budget Rule is also flexible enough to match your income and lifestyle You can change the rule to or 7010 depending on your financial preference Think of it more as a guideline to strategically determine how much money you should be spending on what We often take budget for granted

50 30 Budget Rule Here S Everything You Need To Know

What Is The 50 30 Budget Rule And How It Works Mint Notion

50 / 30 / Budget Cons There are also some things I don't like It's TOO vague The rule doesn't take in to consideration your age, your location, your debt and your income If generally applied this advice to people who are drowning in debt, or on the opposite end, have a HIGH income, it would be WAY OFF"All Your Worth The Ultimate Lifetime Money Plan" This rule helps you divide your monthly aftertax income into three parts, ie 50% goes to your needs, % goes to your savings, 30% goes to your wantsI've been working on our budget recently, and this 50//30 system seems like something I may want to use I was wondering, if we are currently paying $500 a month on our student loans (this is our minimum payment) should that count toward our 50% because that's a bill we are already paying each month, or should it go toward our % because it is part of a debt

50 30 Budget Rule And Spreadsheet With Examples She Saves She Travels

Master Your Finances With The 50 30 Rule

The budget is one of the most popular budgets according to personal finance "experts" In it, you spend 50% on needs, % on savings/debt reduction and 30% on "wants" This is a terrible plan for almost every income and lifestyle The 5030 budget is stupid and I will show you a better wayThe 50/30/ rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably The basic rule of thumb is to divide your monthly aftertax income into three spending categories 50% for needs, 30% for wants and % for savings or paying off debt By regularly keeping your expenses balanced across these main spending areas,5030 Budget Template We designed the above budgeting template in Google Sheets for you to use and download for free Simply click on the image or the orange button below and you will be asked if you'd like to create a copy of our 5030 budget spreadsheet template for your own personal use

The 50 30 Rule Budgeting Calculator Boss Of My Money

1

The 50//30 budget is a very beginnerfriendly way to manage your finances It shows you how to allocate your income according to three categories essentials, savings, and wants The percentages aren't set in stone, but they give you something to aim for, and there's plenty of wiggle room when your circumstances changeThe 50//30 budget rule works for one main reason – it's easy You're new to budgeting You know how much money you make and have a rough idea of how much you spend But you're not really sure about what, exactly, you're spending it on, or if your spending patterns will benefit you in the long runThe 50/30/ rule of thumb is a set of easy guidelines for how to plan your budget Using them, you allocate your monthly aftertax income to the three categories 50% to "needs," 30% to "wants," and % to your financial goals Your percentages may need to be adjusted based on your personal circumstances and goals

The Formula 50 30 Rule For Budgeting Success Canadian Budget Binder

Learn How To Budget For Your Business Using The 50 30 Rule Headoffice Jamaica

At its basic level, the budget divides your aftertax, takehome pay into three buckets The first 50% of your budget goes towards necessities, includingThe 50/30/ rule is a simple way to budget your money, especially for those who are new to budgeting or dislike the idea of tracking every individual expense 50% of your monthly takehome income goes towards your needs, 30% goes towards your wants, and the remaining % goes towards your savings It only requires you to track and divide your monthly expenses into threeThe 5030 budgeting rule is a basic financial rule popularized by senator Elizabeth Warren in her book;

Monthly Budget Planner What Is 50 30 Budget Rule Foxstylo

50 30 Budgeting Rule Calculator Detailed Explanation Intuit Mint

The 50//30 Budget Rule Budgeting may sound like an evil concept to most people, because it conjures up concepts of limiting yourself, labeling everything you want as one giant restriction Some people even try to rename the act of budgeting with positive words such as wealth building process, financial goal planning or dream home systemBeräknad lästid 7 minOne hangup people have with budgets is that they have to do a line by line review of of all of their expenses and income For those new to budgets or people who are busy already it can seem overwhelming If that's you, proportional budgets may be the way to go And for a practical starting place, I'd suggest using the 50//30 budget

The 50 30 Rule Budgeting Calculator Boss Of My Money

The 50 30 Budget Anz

If you want a budget with flexibility, the 50//30 method could be perfect for you And you don't have to give up Netflix to do itRead More https//wwwt50/30/ budgeting worksheet Look at your spending for one month, and record your data on this page 1 Then continue to step 2 on the next page Track and visualize your income and spending for an average month to see how it compares to an ideal budget If50/30/ Budgeting Example Let's take an example, Amir makes $3000 a month ( net income ), that's $36,000 a year That means he should spend nothing more than 50% of $36,000 on Needs ie $18,000 Further, he can spend 30% of his income which is $10,800 on Wants and the rest $7,0 should be saved and invested

How 50 30 Rule Will Change Your Life Finance Expert

50 30 Budget System Rule Short How To Use The 50 30 Budget System Basics Short Youtube

Till det som vi behöver för att levaThe (or 5030) budget rule is an intuitive and simple plan to help people reach their financial goals The rule states that you should spend up to 50For this example, consider an individual who takes home $3,800 a month Applying the 50//30 rule, this would give them a monthly budget of 50% for mandatory expenses = $1,900 Alloting

The 50 30 Budget Rule Explained Ultimate Guide Arrest Your Debt

Budget Percentage Dave Ramsey Vs 50 30 Budget Rule

The rule is a way of organizing the categories of your spending into three percentages If you are a beginner at budgeting, don't let this overwhelm you!If you find that a ZeroBased budgeting method does not work for you, then the 50/30/ budget might be a perfect solution for you The Introduction Of 50/30/ Elizabeth Warren—Senator from Massachusetts and also named by Time m agazine as one of the 100 Most Influential People in the World —introduced the term " 50/30/ rule " for spending and savingUsing the 50/30/ budget, you have $1,500 for your needs, $900 for your wants, and $600 for your savings each month This percentagebased system is designed to guide your spending Understanding that you have $1,500 for your rent, groceries, health insurance, student loans, and gas helps you plan for important decisions, like which part of town you can afford to

How To Build Budget Using 50 30 Rule In Depth Guide Invested

1

The 50//30 rule for budgeting attempts to simplify the budgeting process Essentially, you divvy your take home pay into percentages defined by your budget With the 50//30 budget, fifty percent of your money is set aside for needs, twenty percent for savings or debt repayment, and thirty percent is earmarked for discretionary incomePlease know that this is a gentle starting point When you are figuring out your budget, make sure to use your aftertax incomeThis video is all about how we currently budget our income We are using the 50//30 rule I go into detail of how we spend and save our money If you have

Is 50 30 Budget Rule The Best Way To Budget Tsm

How To Set Up A 50 30 Budget

What is the budget?The 50/30/ rule (also referred to as the 50//30 rule) is one method of budgeting that can help you keep your spending in alignment with your savings goals Budgets should be about more than just paying your bills on time—the right budgetOur 50/30/ calculator divides your takehome income into three categories 50% for needs, 30% for wants and % for savings and debt repayment The 50/30/ budget Find out how this budgeting

Her Money The 50 30 Rule Strong Inc Simple Transitions Render Opportunity Necessary For Growth

50 30 Budgeting Powerpoint Template Ppt Slides Sketchbubble

Using a 50/30/ method you'll plan to spend or set aside your entire takehome pay so eventually, your planned cash flow will balance to $0 Do these steps for the Wants and Freedom groups to work out your 50/30/ budget These are the basic steps for using the out of the box features of the Foundation template for 50/30/ budgetingA budget rule is a great tool!Example of Budget Now that we have broken down the budget, let's use a few realworld examples Mark and Cindy's Budget Mark and Cindy both work fulltime and their household income is $110,000 per year Their takehome pay (aftertax) is $6,500 per month 50% Needs = $3,250

Budgeting For Those Who Don T Like To Mogo

Budgeting Tips For Canadians The 50 30 Rule

The 50 Needs 30 Wants Savings Method Of Budgeting Words Of Williams

Gor En 50 30 Budget Guide Och Kalkylator Sparhaj

The 50 30 Rule Of Budgeting Explained Dollarsprout

Economy And Finance Box How To Budget Your Money The 50 30 Rule Budgeting Personal Financial Planning Finance

The 50 30 Budget Rule To Save More Money To Be Honest

Free 50 30 Budget Calculator For Your Foundation Template

The 50 30 Budget A Simple Guide And Free Template

3 Types Of Budget Plans To Help You Get Started Boss Life In Progress

The 50 30 Budget Rule Made Simple Cents Accountability

The 50 30 Budget A Simple Guide And Free Template

50 30 Budget Rule And Spreadsheet With Examples She Saves She Travels

50 30 Budgeting Rule Of Thumb Pharmacist Money Blog

What S The 50 30 Budget Rule And Is It Right For Me Debt Negotiators

How To Budget Like A Pro With The 50 30 Rule Compounding Joy

Budgeting Made Simple My Money Guides Ybs

Edes Associates What Is The 50 30 Budget Rule A 50 Of Your Income Should Go To Living Expenses And Essentials I E Rent Utilities And Things Like Groceries And

How To Create A 50 30 Budget Financial Stress

:max_bytes(150000):strip_icc()/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1-5ecfc51b09864e289b0ee3fa0d52422f.png)

The 50 30 Rule Of Thumb For Budgeting

How To Follow The 50 30 Rule Wealthsimple

When It Comes To Managing Your Money Regardless Of 50 30 Budget System Clipart Pikpng

50 30 Rule A Realistic Budget That Actually Works N26

Fly Initiative Sur Twitter The 50 30 Budgeting Rule Is A Well Known Rule Of Thumb And Considered Easy To Follow The 5030rule Helps You Build A Budget By Using Three Spending

Pin On Budgeting Group Board

What Is The 50 30 Budget Rule Fox Business

50 30 Rule Of Tracking Budget Yadnya Investment Academy

In Allocating Your Money Do You Follow The 50 30 Rule Toluna

What Is The 50 30 Rule Budget Paragon Bank

50 30 Budget Kimberly R Jones Budget Planning

50 30 Budget Rule And Spreadsheet With Examples She Saves She Travels

50 30 Budget Calculator Nerdwallet

How To Create A 50 30 Budget Financial Stress

50 30 Budget Rule Woman Can Apply In Her Daily Life Savvywomen Tomorrowmakers

Gor En Hushallsbudget Enligt 50 30 Regeln Basta Satt Att Fordela Ratt

Money Lover Blog Understand 50 30 A Simple Budgeting Rule

Struggle With Budgeting Try The 50 30 Financial Rule Ocean Finance

Livewell The 50 30 Rule How To Make Budgeting Easy As Pie

The Formula 50 30 Rule For Budgeting Success Canadian Budget Binder

The 50 30 Budget Method Defined Financial Best Life

Why The 50 30 Rule Sucks The Simple Sum Singapore

Everything You Need To Know About The 50 30 Budget Rule Money After Graduation

How To Budget For Monthly Rent 50 30 Rule

3

The 50 30 Budget Explained An Easy Budgeting Method To Follow

Smart Money Your Expert 50 30 Budget Buddy

Is The 50 30 Rule The Best Way To Budget Your Money Earn Money Online Quiz Contest In India

Amb Credit Consultants A New Way To Budget Budgeting Using The 50 30 Rule

Do You Know About The 50 30 Rule

The 50 30 Rule Ramseysolutions Com

50 30 Rule Free Excel Budgeting Template Dollarplaybook

50 30 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny Money Saving Strategies Financial Budget Finance Saving

50 30 Budgeting Rule Save Money Australian Lending Centre

How To Budget Like A Pro With The 50 30 Rule Budgeting Finances Budgeting Budget Spreadsheet

The 50 30 Budget A Simple Guide And Free Template

50 30 Budget Ppt Powerpoint Presentation Show Graphics Design Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Free 50 30 Budget Calculator For Your Foundation Template

How To Budget With The 50 30 Rule Swift Salary

50 30 Regeln Hur Bor Budgetera Var Inkomst Manity Se

Revisiting The 50 30 Budgeting Rule

How Does The 50 30 Budget Rule Work Mymoneysouq Financial Blog

The 50 30 Budget Rule A Simple Step By Step Guide Money In Your Tea

50 30 Budget Ppt Powerpoint Presentation Show Graphics Design Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Smart Budgeting 50 30 Rule Smartmoneyideas

Budget Your Money With 50 30 Rules Invest In Yourself Eunoia Women

How The 50 30 Budgeting Rule Works

How To Budget With The 50 30 Rule Swift Salary

50 30 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny

What Is The 50 30 Budget Rule And How It Works Mint Notion

50 30 Budget Rule Infographic 50 Essentials Savings 30 Personal Budgeting Money Lessons Finance

The Ol 50 30 Budget Rule Really Works Budgetry

Budgetriktlinjen 50 30 Aktiemiljonar

50 30 Budget Calculator And Explanation

How To 50 30 Your Budget Theskimm

The 50 30 Budget Rule A Simple Step By Step Guide Money In Your Tea

コメント

コメントを投稿